Fall Tucson Gem Show Application

To apply to exhibit at our upcoming event, please follow these instructions:

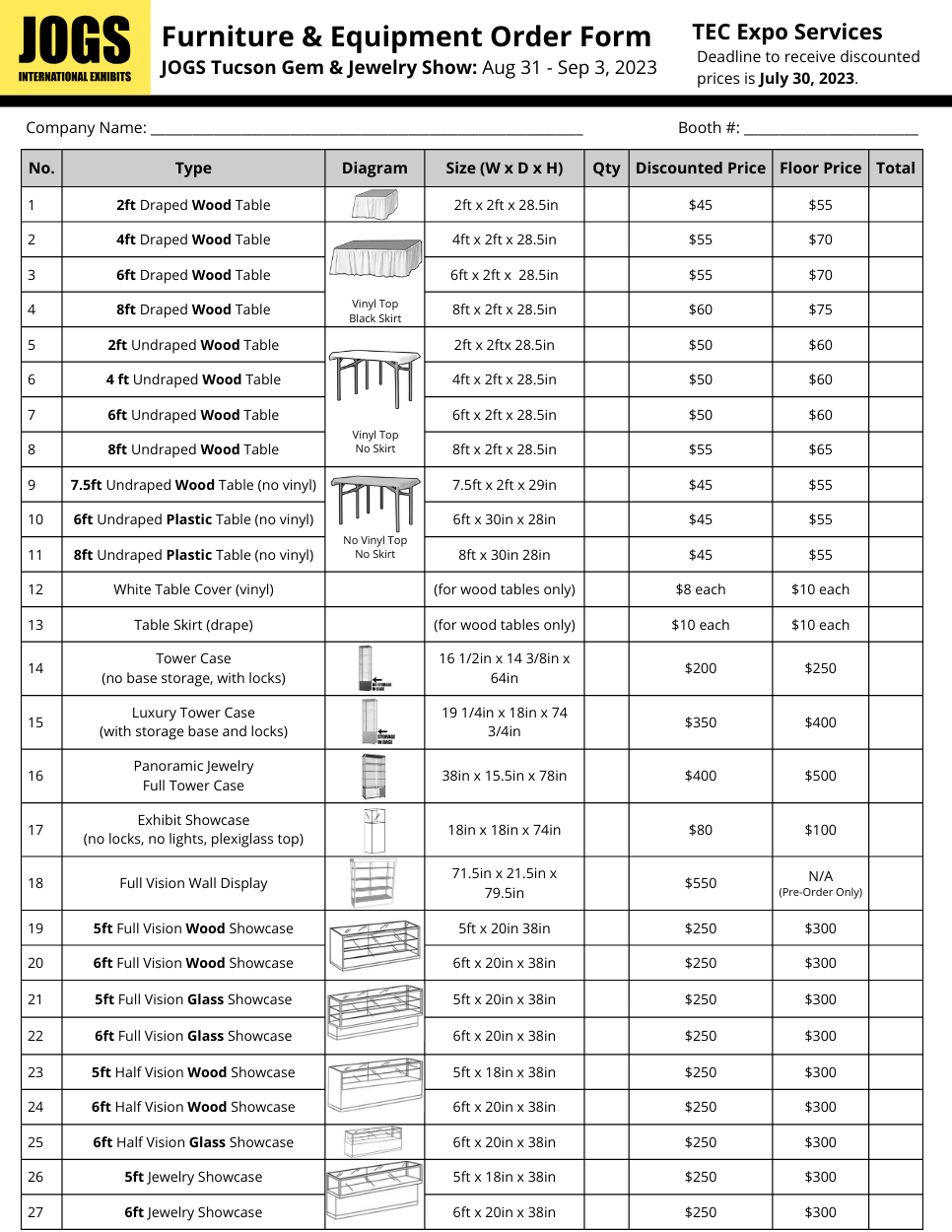

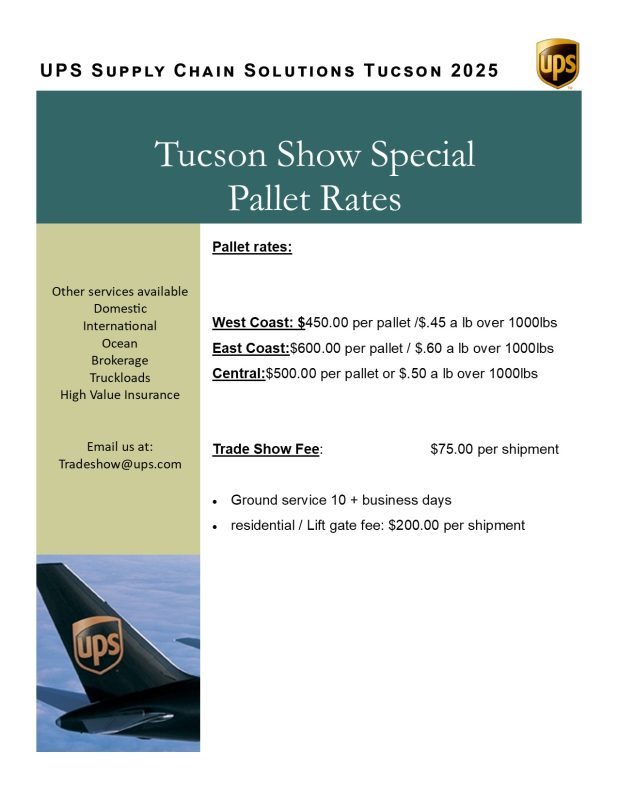

- Click on the red “Download PDF” button to download and open the PDF file that contains the exhibit application and contract, along with the booth prices and other important information about reserving a booth.

- Review the information in the PDF file carefully to determine the booth size and location that best fits your needs.

- Complete the application and contract form and ensure that all required information is filled in accurately and completely.

- Submit the completed form along with any additional required documentation via email to info@jogsshow.com

- If you prefer to apply online, you can also click on the “Apply Online” button and follow the prompts to submit your application and reserve a spot.

- Once your application has been received and processed, we will confirm your booth reservation and provide you with further instructions and details for the event.

We look forward to receiving your application and having you as an exhibitor at our upcoming event.